The World of APIs

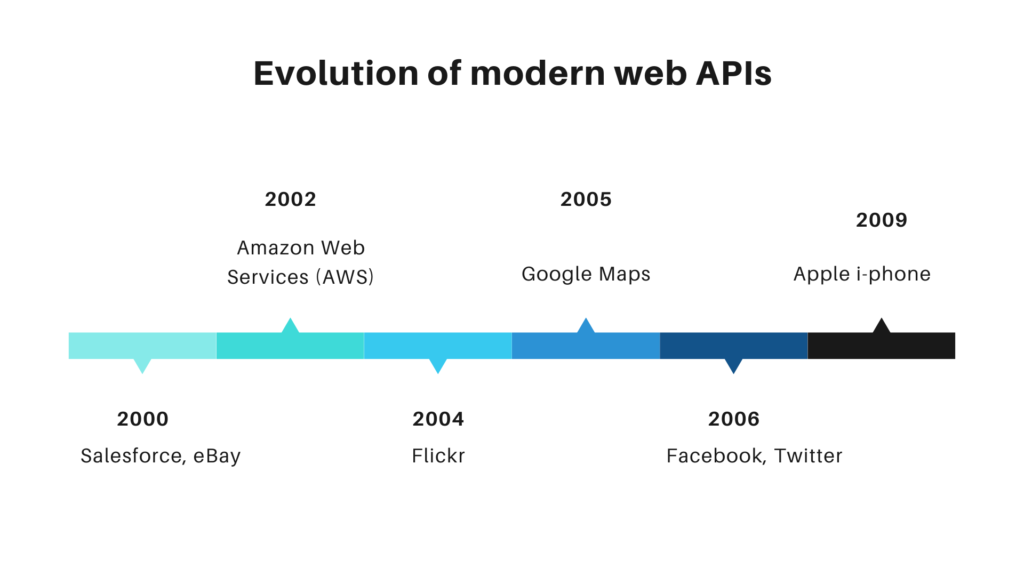

If you are using a travel site to book flight tickets or an entertainment app to book movie tickets or simply making payments through your mobile, you are using APIs- the technical name for programs that help software systems connect with one another and perform tasks by sharing information. Closer to home, a telling example was in the post-demonetisation period when Quikr brought out CashNoCash, an application that directed users to the nearest ATM where cash was available and even told them how long they would have to wait in the queue. It did so with an API which used crowdsourced data. Here’s a history of how modern web APIs evolved (although APIs have been around since the 70s).

- Modern web APIs officially born in 2000 with the launch of SalesForce automation;eBay also rolled out its API to select partners

- In 2002, Amazon launched AWS allowing third party sites to search and display products from Amazon.com.

- In February 2004 the popular photo sharing site Flickr launched

- In 2006, Facebook launched its development platform and API, allowing developer access to FB friends, photos, events and profile information.

- Same year,Twitter API released in response to the growing usage of Twitter by those scraping the site or creating rogue APIs.

- A year before, in 2005, Google Maps API was launched again in response to the number of rogue applications that were hacking the Google Maps application.

- The game changer was mobile phones, after social and cloud. Apple launched iPhone3G in 2009 and opened up an entire new world of mobile applications using APIs.

APIs do a lot of work- they specify how software components should interact, communicate internally within a system and also with the services of external parties. What helped was the growing popularity of cloud because earlier, on-premise applications were not as openly allowed to exchange data with external applications for security reasons

RapidAPI, the largest API marketplace in the world with over 10,000 APIs and 1,000,000 active developers, lists the following as the most popular in India in recent times.

Entertainment, sports and social apps figure areon top – indicatingthe emergence of a new API economy that has turned many businesses into platforms. The popular BookMyShow app is built around APIs- it has about 200 services exposing around 1,000 APIs to give customers a complete and seamless experience. APIs are no longer a business choice for any consumer facing business. Companies such as Amazon, Facebook and Google offer APIs to connect to their services and others like Uber are API companies that feed their business with third-party interfaces to provide services to their users. Even the government got into the act. Its initiatives such as AADHAAR API and India Stack have been the backbone of most digital developments in FinTech today. It has various other APIs also on data.gov.in, which provide data on weather, air quality, elections, commodity prices, various government schemes and more, which can be leveraged by businesses.

However, it is in finance and banking that APIs are playing their most significant role yet. The easiest way to understand how things have changed since APIs is to consider the simplest of processes – loan disbursement. Two decades ago, it took at least four to ten days for an average bank to disburse a personal loan; while today APIs enable them to do so within five minutes. But the game changer has been Open Banking,although kick-started in Europe by Governmental regulation, it is entirely a child of the API economy. The Platformication of banking is premised on a simple but intuitive belief – banks are good at attracting customers while technology is good at creating products and services. By getting them together on a platform (exposing bank customer data, with consent, to third party developers) customers could benefit from a wider range of competitive and customized financial products and services, than they would from being the customer of a single bank. The European PSD2 directive which triggered Open Banking was only about payments, but in India there have been two initiatives – one on payments. the Unified Payments Interface (UPI) in 2016 which completely revolutionized payments and two, the Account Aggregator (NBFC-AA) regulations or the sharing of customer financial data, which is the real money-spinner. This is a sort of UPI for financial data and the stage is now set for aggregators to come in and transform the product scene.

But banks in India have been at it already by setting up API platforms. Yes Bank was an early starter. Through API services, it digitized the B2B supply chain, enabling clients to perform their banking related activities from their own ERP systems using APIs across broad functional areas such as Accounts, payments, cards and CRM through secured system integration between the corporate customer’s ERP and Yes Bank. ICICI bank also has launched its ‘ICICI Bank API Banking portal’, with about 250 APIs and the categories enabled are payments & collections, accounts, deposits, cards and loans.

In the banking world, APIs have already made their presence felt in payments. But the truly big impact of APIs will be felt when customers are able to shop around for financial products and services without having to change banks or account relationships. APIs could well change the face of banking as we know it today, just as much as Uber transformed transportation.