Vanakkam! Śubhēcchā’ō! Namaste! – The language paradigm in India’s financial inclusion journey.

With every nook and corner of India embracing the digital way of banking, further catalyzed by a raging pandemic, an interesting fact emerges. A 2019 November survey by the Internet & Mobile Association of India (IMAI) and Nielsen reveals that, for the first time, rural India now has more Internet users than urban India. Although the 227 million users are only a quarter of the total rural population of India, there is a huge potential that is waiting to embrace digital banking, led by a rural surge.

The Jan Dhan-Aadhaar-Mobile (JAM) trinity program initiated by the government has enabled benefits worth ₹1.70 lakh crore reaching the citizens directly through their bank accounts. With 1,30,000+ mega financial literacy camps organized to cater to the rural audience, the prevalent use is yet to catch on. So, what is needed to bridge the gap, and get each one of our rural folks to use banking apps? The key is to address the gaps in language communications, and to build bridges to communicate in regional languages to bank the unbanked.

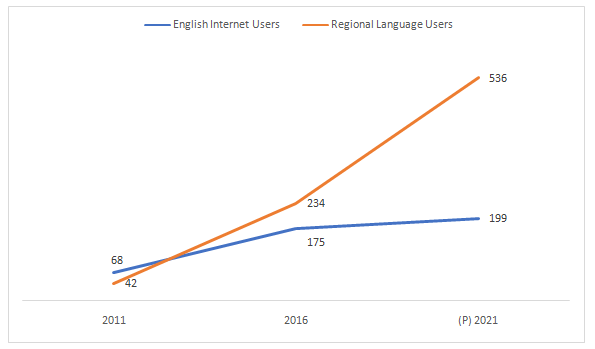

Regional Language Internet users

Graph shows the growth of Internet language users over the decade of 2011-21 (Source)

Since 2011, Internet service providers have been upping their content in regional languages. Regional language user base (pre-pandemic) has been growing at a cumulative annual growth rate of 18 percent as compared to 3 percent of Indian English user base. Coupled with the pandemic, cheap Internet plans and the need to reach the last mile for various government initiatives, the move towards regionalization and localization has started to accelerate.

Trends

The legality of contracts largely relies on words – hence, language becomes a dominant focus in business dealings and correspondence, that includes marketing. Many websites including Amazon, Flipkart, Facebook are now available in regional languages, which has proven to be an effective strategy. From a business standpoint, communication in the regional language has already been gaining momentum, with companies such as Lionbridge, Williams Lea Tag, Welocalize, and Magnon working multi-site contracts for global majors that are offering products and services in India, such as in the ecommerce and financial services sector. Flipkart revealed that every day, 1.5 million users visit their ecommerce website to browse in their native languages. ‘Voice, vernacular, and video’ seems to be their strategy to cover the last mile.

Multilingual nation needs more than a dual language approach

In a country where there are 22 official languages, and 122 which are spoken prevalently, only 12 out of 36 states (and Union territories) opted for Hindi as the first choice for communication. When it comes to the banking sector, the most common options henceforth have been English and Hindi. This dual language approach has put millions of users in the dark, who find it difficult to understand the banking process – right from receipts, acknowledgements, forms, confirmations etc – as their language expertise lies beyond both English and Hindi. This is where language localization fills the gap.

BaaS in Regional Languages

In a study by Member of Parliament Tejaswi Surya from Bengaluru, almost 81 percent of those who are employed in the Regional Rural Banks (RRBs) in Karnataka are not from the state, and most of them do not even know the basics of the language. The announcement by FM Nirmala Sitharaman on ensuring the employment of local tellers that can speak the prevalent local language has been widely hailed in the vernacular media as a welcome decision.

Benefits from Regional language adoption

In a country like India, a lot of decisions are still made based on the price more than other attributes.

- The publication of commitments and services offered by banks in the local language hikes the reliability factor of banks among the common folk, increasing engagement and strengthening loyalty. ICICI’s Mera iMobile stands testimony with over 1 million downloads with 12 language options.

- Engagement rate is high when it comes to localized content – be it charges or new product announcements, Indians respond better to publications in their regional languages. A KPMG study suggests that 88 percent of Indians respond better to a digital advertisement in regional languages than English.

Watch-out-factors

Banks taking the language localization route should keep a few concerns in mind to maximize the benefits of it.

- Cost: Having software that offers multiple-language for multiple-users comes at a price along with complication. Prudence in cost management goes a long way.

- Accuracy: The translated content be it a report, document – legal or financial documents need to be verified for accuracy. Multiple checkpoints and independent verifiers are a must.

- Sameness: Whichever information is published, it should be consistent across languages, and yet, appeal to the local sensibilities, especially for marketing. Sameness doesn’t mean just the words in various languages, but the idea behind the creative must be communicated in a well grounded, localized manner. Any guffaws in that direction are bound to be blown up on social media as memes and jokes.

- Dialects: The dialects in which the same language is spoken differs across a population should be kept in mind. Any insensitivity may attract heavy bashing or comments from the public.

While it might look daunting, thanks to APIs – multiple-languages can be a part of the banking ecosystem through minimal effort as an add-on. The language/dialect-specific APIs can find its use in multiple other apps, and truly open up the digital world to everyone in India. Translation agencies that feed into the content systems through APIs make use of highly evolved translation memory software and back-end integrations, that enables speedy execution of translation across multiple languages without errors, omissions, or delays on the same footing. This functions just as a multi-national newsroom would, when presenting the same news reports to different language audiences.

Using APIs for translation is not only easy, but also reduces costs, and increases effectiveness for bankers. As customers gain easy access to their banking services and offerings in their local tongues, the trustworthiness in the formal route of credit increases, and subsequently, their dependence on loan sharks and informal credit circles lessen, sparking a positive cycle. Today, India is at the cusp of one of the major digital revolutions of adapting to regional languages. Now the onus is on the banks to make the most of it.