Supply chain risks in banking

Supply chains- the value network consisting of sourcing of raw materials, manufacturing, outbound logistics, channels and demand management- took a massive beating from the pandemic. As COVID-19 related lockdowns overwhelmed country after country, firms and businesses experienced supply shocks in the forms of both disruptions to the availability of goods sourced from China as also the vast global outsourcing chains where components and raw material came from a swathe of countries. Besides, countries also faced something completely new-demand shocks, where people began stockpiling goods in order to comply with restrictions on movements.

Do financial services such as banking have the equivalent of a supply chain? Should they worry about how integrated they are to face external shocks such as this? These are interesting posits, because nothing comparable exists, though we can map out a supply chain, for , say, the making of a loan to a business through a sequence of front-middle and back office processes. Of course most of the banking services have well defined processes and operational risk controlsaddress a wide range of eventualities, such as power failures, network disruptions and even acts of God. Likewise they also address internal risks such as frauds, security breaches and the like. But it is not clear if they are geared to shocks such as financial events- a market crash, the collapse of liquidity, or the impact of a deep recession triggered by a pandemic.

It therefore makes sense for bank to revisit all its processes, map them granularly in relation to its critical businesses-payments, lending, investments-toassess how a disruption would impact any of the nodes alongside the supply chain for each of those financial activities and how long it could take for the system to recover and continue operations.

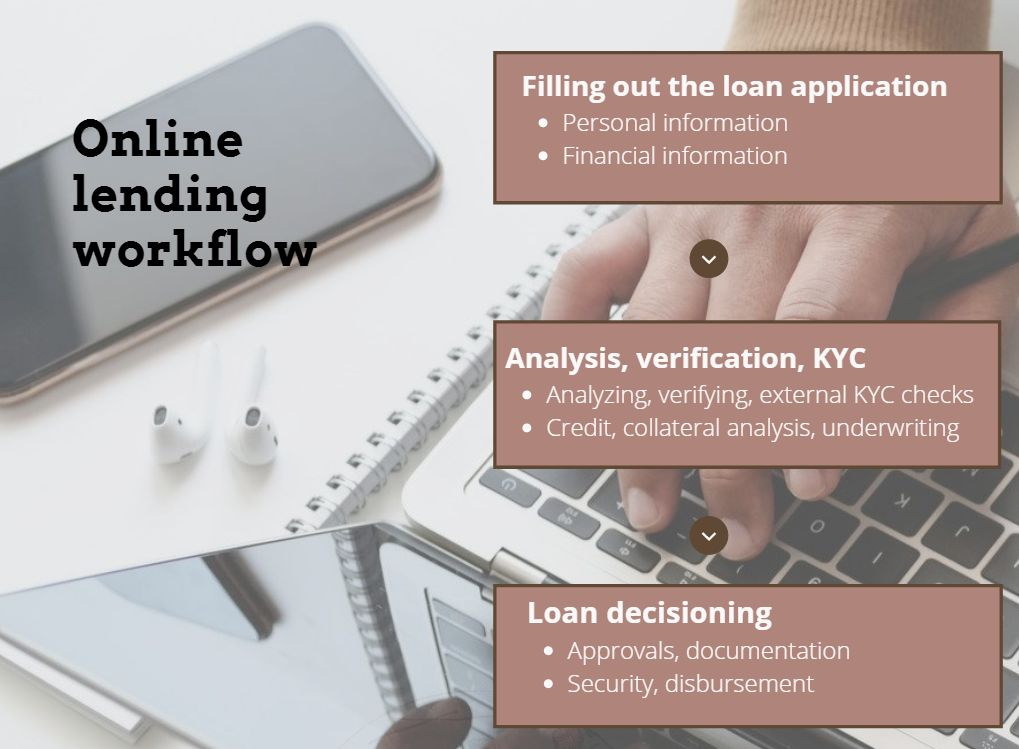

For instance, the typical online lending workflow of a bank or NBFC could look like this:

Luckily,because lending is digital nearly everywhere today, human touch points (on either side) are far and few. The RBI has allowed digital KYC as well and today it is possible to design a seamless and contactless process flow. Even credit underwriting has been transformed- there exist proprietary scorecards for borrower evaluations, automated solutions using AI (machine learning and deep neural networks) for credit risk evaluation; but there are different challenges now- the impact of Covid-19 has weakened the value of the data used in rating systems. For example, the typical data that these systems use-payment track record, cash flows- to test an SME’s credit risk is rendered meaningless by the economic shock caused by the pandemic. Therefore rating an SME based on pre-crisis data, either from balance sheets or Credit Registries may no longer be reliable to assess a business’ current situation. Cash flow priorities of firms may have changed-paying salaries takes priorities over paying suppliers or lenders. And since most lenders have also offered moratoriums, we may need newer ways of assessing debt servicing capabilities or intentions. The traditional scoring systems would interpret this negatively and cause automatic downgrades, increasing the cost of credit and also reducing access to new credit. The challenge is of being able to distinguish a viable businesses from a rogue borrower, because “inaccurate” selection not only impacts the lender but also the overall economic recovery plan.Adopting Open Banking could help here as it enables real-time, and a wider view of financial data. Rather than just past data, open banking can provide risk management the ability to score a company on its capacity to generate revenue, by say, looking at all liquidity and transaction data from transactions in its bank account. Not just account balance data, but algorithms can categorize transaction data such that expenses and cash outflows can be assessed meaningfully.

Another back office process susceptible today is HR. Traditional operational risk management may be good at handling traditional human resources issues such as poorly trained employees, negligence, misconduct or fraud; but a completely new working style-working from home- is a different ball game. Again, because of digital progress, the makeover may be easier today but a different set of challenges emerge- the cost of support, connectivity and data security issues, to name only a few. There could also be issues if any key middle or back office functions have either not been automated or amenable to automation

Finally, the impact of economic and financial events. This is by no means a new risk but traditionally has been handled at the macro level through policy responses and strategies. But systemic shocks such as pandemics are sudden and unleash impacts that cannot wait for a macro policy response, such as the drying up of liquidity or borrowers’ repayment cash flows not materializing. In manufacturing, resilience measures typically include dual sourcing practices for critical inputs, reserved production capacity, maintaining safety stocks in both outbound logistics and in the channel and improving demand forecasting accuracy. Banks and financial institutions must devise their own measures.