Is digital lending the ‘GAME CHANGER’ in the financial block?

Astonishing, isn’t it? This exploding term (digital lending) is quite the buzzword in the world of digital transformations.

But how exactly does this trend transform the lending game? Well, it’s time we figure that out.

Digital lending:

Digital lending is the process of incorporating digital technologies to automate loan processing.

It can be as simple as creating an online loan application module to process loans or can be as extensive as a unified digital lending platform automating the entire lending lifecycle (origination, underwriting, assessment, decisioning, sanction, management, closure etc.)

The digital lending software simplifies complex processes, configures standard business rules, performs credible risk assessment of borrower and enhances credit decisioning via automated data verification interfaces. The system encompasses automated workflows to ensure timely completion of each module in a lending process.

How is digital lending transforming lending space?

The lack of prudent risk assessment and a rigid eligibility ceiling in manual lending processes limits the potential borrowers from availing loans. More so, these systems fall short in terms of time, speed, complexity and satisfactory aspects.

Whereas the new-age digital lending systems offer loans for credit-worthy borrowers purely based on their risk assessment metrics (credit rating) and helps cut down cost-overheads with its digital-first approach and prudent analytics.

These digitally streamlined systems guarantee loans for borrowers with minimal paperwork thereby aiding financial institutions to minimize compliance and accelerate loan processing.

With e-advancements like digital lending becoming the norm today, getting loans is just a click away.

Growth of digital lending:

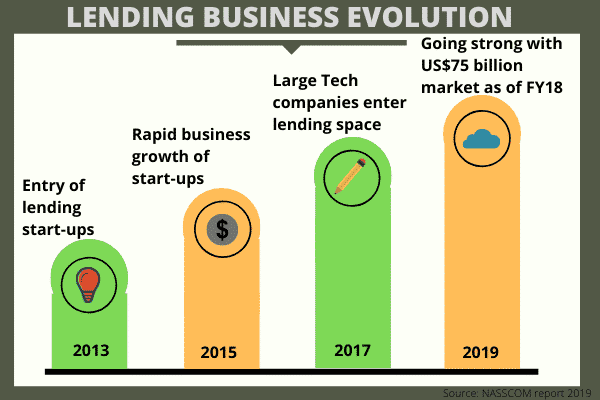

Digital lending, the next big thing in BFSI, has been growing leaps and bounds, thanks to the increased adoption of all things digital. The demand for this space is evident from the growth in investments and operation of lending tech startups. Till date, there are a total of 330+ digital lending start-ups with a total investment of 25.49% ($1.49 Bn) in India.

Factors driving the growth of digital lending:

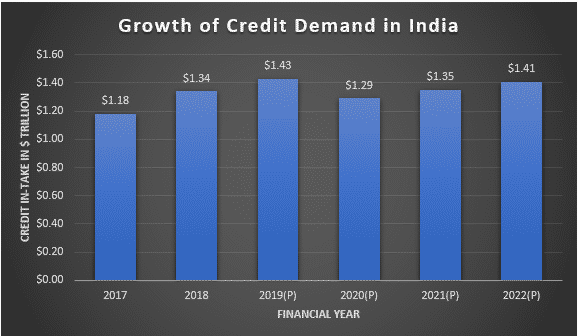

Widespread internet penetration (540mn Internet users in India), higher credit demand(depicted in the graph), quicker ‘Time to cash’, reduced TAT (Turn Around Time), the list is endless.

Source: Digital lending start-ups

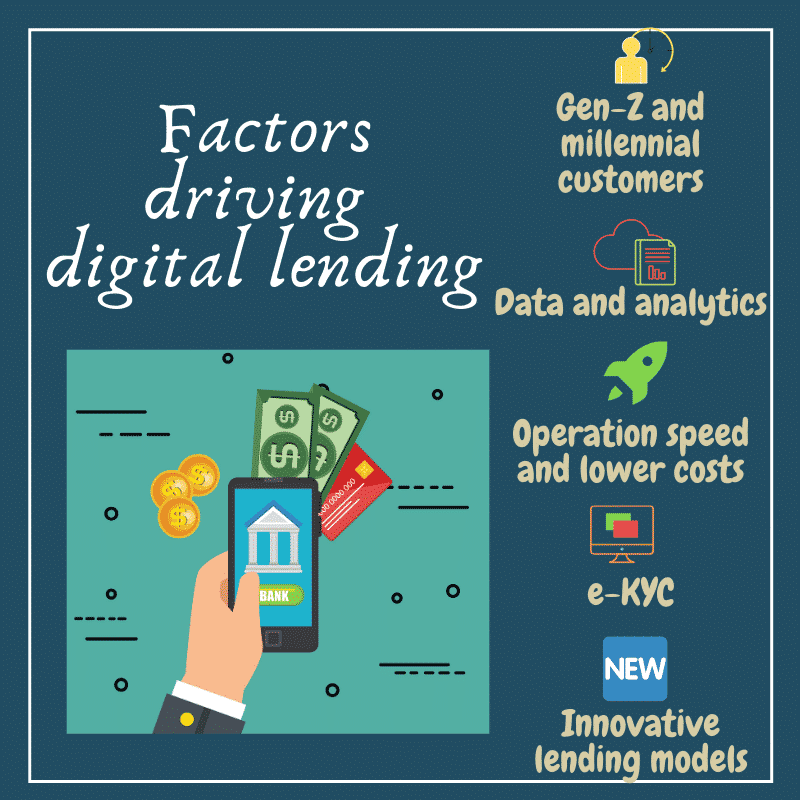

Let’s look at some of the major factors driving this trend.

- Gen-Z and Millennials:

Research shows that 37% of customers want an Amazon-like banking experience.

That’s right! Gen-Z, Millennials love anything and everything instant. They want the same from their financial institutions as well. All they look out for in a lending solution is ease of access to funds powered by a one-tap digital lending experience.

- e-KYC (electronic – Know Your Customer):

KYC, one of the most fundamental processes of a lending system, is crucial and cumbersome at the same time. The consent for e-KYC by Supreme Court allows digital lending systems to instantly validate KYC data via parallel processing to ease authentication and enable faster customer onboarding.

This has encouraged FinTech firms in creating online API marketplaces that effortless integrates various data services via a unified platform to facilitate instant data capture and verification.

It’s time to let papers fly away!

Source: Customer experience, the next battleground in lending, Digital lending – a sector that continued to grow

- Analytics and intelligence:

Data is the holy grail of every system; lending is no exception to that. Since the entire process is digitized, it is easier to connect these digital data points to

- Offer personalized services to improve customer engagement

- Identify new revenue streams

- Manage lending risks by advanced analytics

- Revamp products and services with latest features

Connect these dots to hit the jackpot!

- Digital advantage:

This is proof that the ‘digital’ factor works well for consumers today than ever before.

The sheer advantages posed by digital technology reduces time to market, enhances the extensibility of business solutions, and offers customers a hassle-free borrower experience. These digital solutions eliminate the need to maintain a brick-and-mortar system or a high-maintenance legacy setup and is cost-effective.

- Innovative lending models:

The most sought-after digital lending models are not just restrained to online but cover many more. These new-age digital lending models enables one to avail funds at the comfort of one’s home via their smartphones (mobility solutions).

Other lending models:

- POS based lending

- Bank FinTech partnerships

- Invoice discounting

- Marketplaces

- Bank-led digital models

- Captive model

- P2P lending

BCG Digital lending report has found that,’ Around 5 million loans have been disbursed through 3-1-0 approach. (3 minutes to decide, 1 minute to disburse, 0 human touch) ‘.

It’s truly mind-boggling that an entire legacy lending system is reaping the benefits of digital transformation that adds nothing but significant value to the process.

Hands down, digital lending is nothing short of a “GAME CHANGER” of lending tomorrow!