Digital lending 101

As per the BCG Digital lending report, total digital lending contribution was 75 billion as of 2018 and is forecasted to be 110 and 150 million by 2019 and 2020.

This is proof that digital lending is no longer a ‘differentiator’– it has become a strategic imperative.

Going digital with lending:

Digital lending is one of the finest transformations of the on-going digital revolution. A decade back, getting access to funds was a tough nut to crack.

Not anymore!

Today, customers have access to various digital lending channels that assures them funds within a click of a button. Thanks to digital lending!

Now, let’s dig a little deeper to understand the basics of the phenomenon – digital lending.

Digital lending as they call it:

A traditional lending process can be broken down into a series of sub-processes: applying for a loan, getting approval, sanction,repayment and closure.

Shifting the core lending process into a complete digital experience is what they call as ‘Digital Lending’.

In other words, digital lending is the process of handling all stages of a loan lifecycle via digital means.These systems enable lenders to accelerate their credit decisions for a better customer engagement.

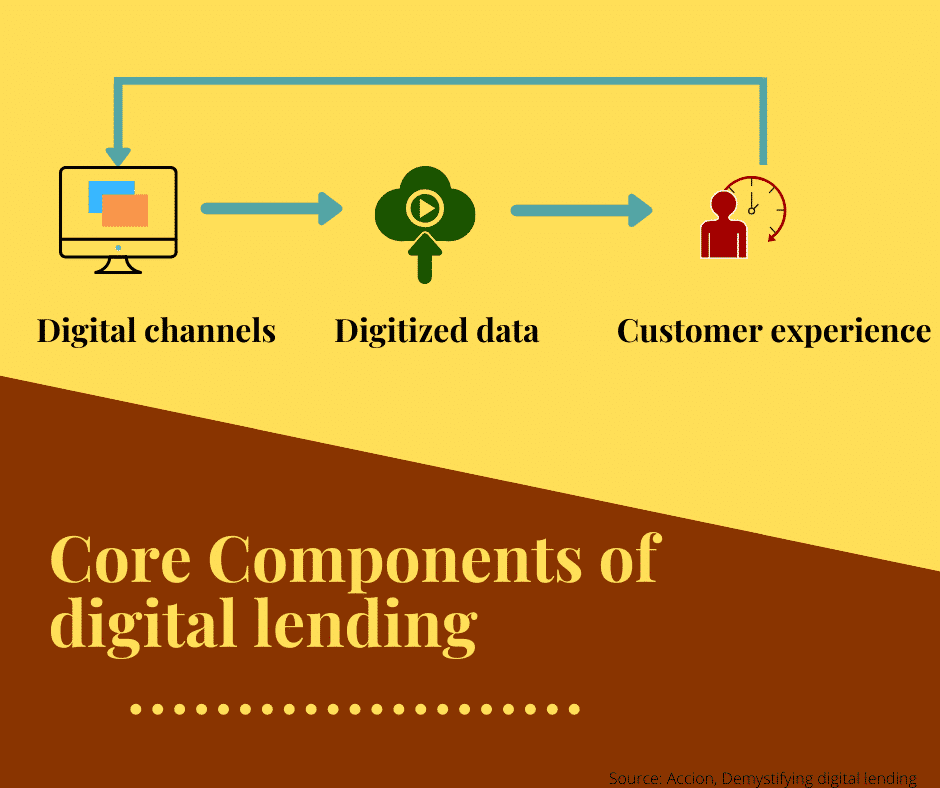

Core components of digital lending:

The ideology behind digital lending revolves around the below components:

- Leverage Digital channels:

Lenders must take advantage of the digital mediums to provide borrowers with access to their loan portfolio on the go.

- Banking on digitized data:

Data combined with digital techniques andalgorithms predicts customer’s intent based on behavioural patterns and helps improve theoverall lending experience.

- Prioritize customer experience:

Digital lending enables faster approval, quicker ‘time to cash’, ‘time to yes’ etc. to simplify customer journey.

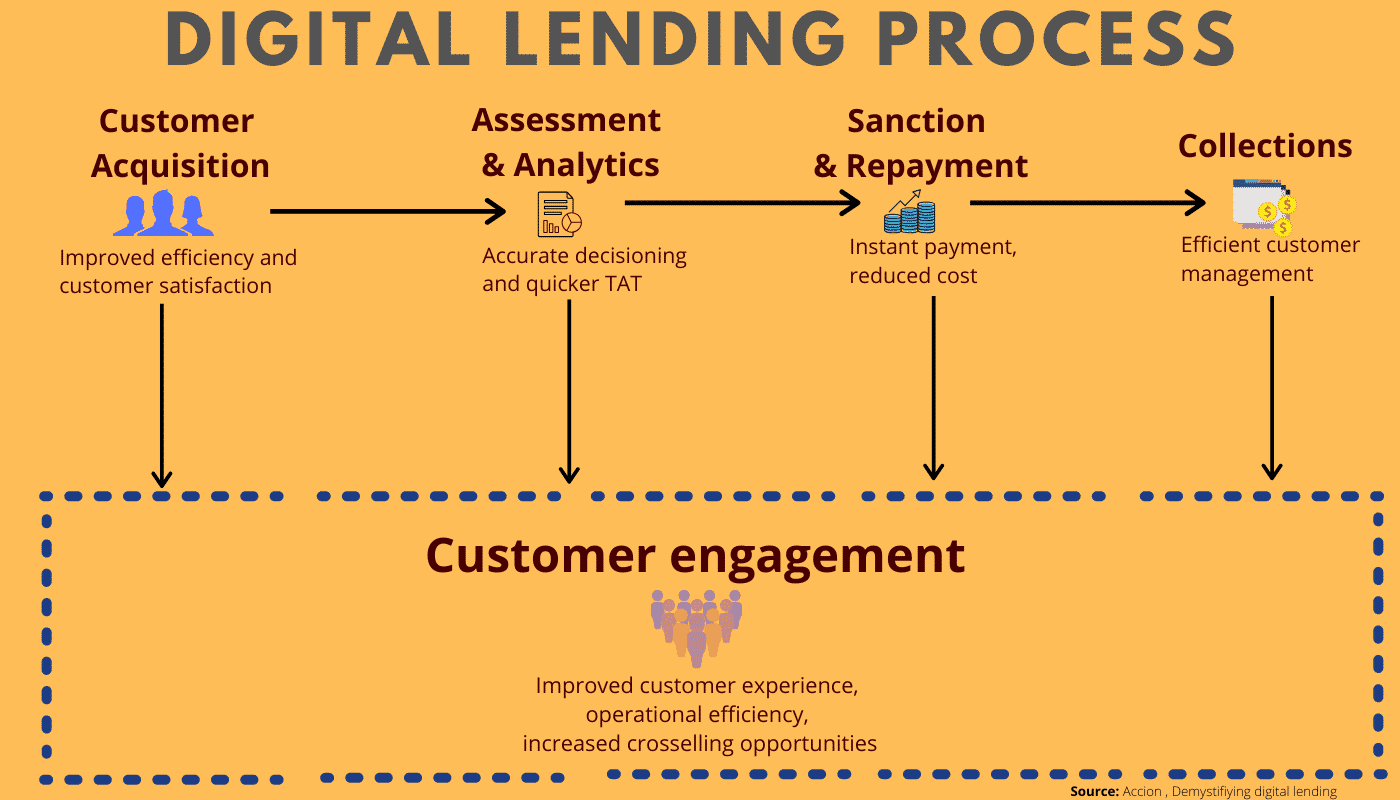

Digitizing lending lifecycle:

Source: Accion – Demystifying digital lending

A complete digital lending lifecycle involves a series of steps right fromcustomer profile creation, risk evaluation, eligibility assessment, decisioning, sanction, management until closure.

Let us look at how digital lending has redefinedeach of these stages:

- Customer onboarding:

The primary step in a lending process is customer onboarding. Through various digital onboarding channels (mobility, online application, SMS blast), customer profile creation is initiated and completed in minutes.

The onboarding process involves collecting basic customer data- KYC (Know Your Customer), eIDAS(electronic Identification and Authentication services) and financial documents from the borrower.

Since digital lending puts customer experience on the forefront, the digital application form collects bare minimum details (PAN/TAN/AADHAR etc) and validates the rest via open banking API integrations and bio-metric authentications.

- Assessment and approvals:

Once we have the applicant data, the next vital step is to perform a rigorous financial assessment of the borrower. With the help of advanced risk-management tools, digital lending systems determine the credit-worthiness of borrowers to speed up the underwriting process.

An in-built automated system breaks down vital processes into “nodes” to ensure timely completion of each task.Hence, as and when the applicant’s risk and eligibility assessment is complete, the workflow system pushes the digital application onto the sanction stage.

- Sanction and repayments:

Upon completion of preliminary assessments, the application is then moved to final decision making stage, where lenders either approve or reject the loan request. With the help of smart notifications (via SMS, mail etc), digital lending systems enable approvals on the go and allows authorities to override approvals in event of rightful applicants.

Based on the decision of the lender, a rigid management system takes over to handle the disbursement and post-disbursement activities (account monitoring, repayment cycle). The system enables sanction and repayment collectionvia digital mediums (bank accounts, e-wallets etc.) to ensure hassle-free disbursement in minutes.

- Collections:

The lending process isn’t complete just after sanction. The amount lent to borrowers is yet to be collected as scheduled repayments on a periodical basis.

This seems complex; how does digital lending systems go about it?

It has an automated collection system that helps lenders collect and track their repayments in real time. The digital dashboard interface helps maintain proper accounting records for all transactions.

Coupled with a powerful monitoring system, the digital loan collection model predicts risk patterns based on their audit trials and cautions lenders (based on RBI defined Early warning signals) to take recovery strategies in the event of any delinquency.

All the above pillar processes of digital lending in-turn are tuned to retrofit modern-day customer expectations and maximise customer satisfaction.

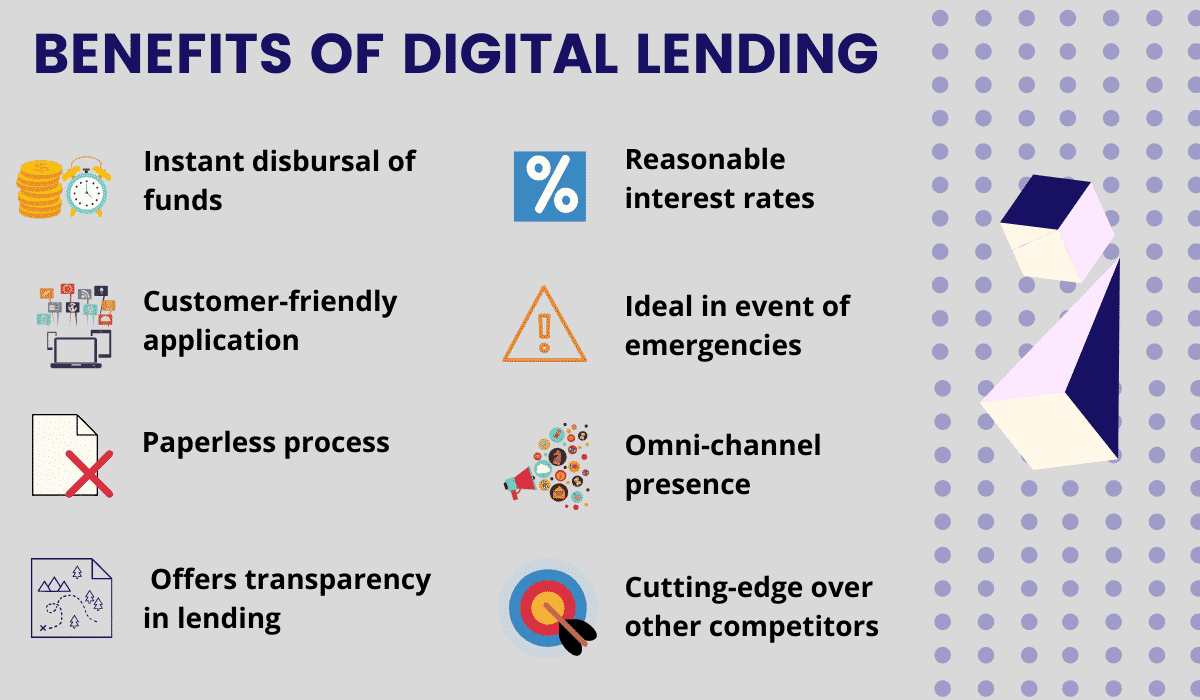

Benefits of digital lending systems:

A study has found out that mobile is the predominant choice of 98% of loan seekers.

When customers are already in for digital ride(for loans), what’s stopping the lenders?

– Bruce Lowthers, Co-chief Operating Officer, FIS

As quoted by Bruce, if maximising lending potential and prioritizing customer experience are your goals, then it’s time to say ‘Yes’ to digital lending.