Digital revolution is here, and what more of a testament could one ask for than the RBI’s latest announcement.

That’s right!

RBI’s circular on January 9,2020 was the talk of the town not just among industry professionals in the BFSI segment but across the entire gamut of industrial ecosystem.

Let us understand how this remarkable decision pans out for the banking and FinTech community.

RBI taking the digital route:

With a view to leveraging the digital channels for Customer Identification Process (CIP) by Regulated Entities (REs), the Reserve Bank has decided to permit Video based Customer Identification Process (V-CIP) as a consent based alternate method of establishing the customer’s identity, for customer onboarding.

In a first-of-its-kind regulatory move, RBI has given its nod for conducting KYC (Know Your Customer) procedures via video recordings. This amendment is a fine alternative to the existing KYC modes (offline, e-KYC) and is hassle-free. With video KYC in place, banks, FinTechs, lending service providers can complete their customer onboarding processes within no time.

Why is this move so monumental?

KYC is a pre-requisite set of procedures conducted as part of basic customer onboarding across business entities. KYC data gives insights about the customer and helps organizations understand and serve them better.

Financial institutions too, carry out KYC for the same underlying purpose. This crucial aspect helps financial service providers understand its customers, their financials & risks to make realistic product offerings.

As the process involves quite a lot of data-handling, streamlining CIP (Customer Identification Process) has always been a challenge. Even with e-KYC (electronic-KYC) which employs digital means for data capture and processing, there is demand for physical presence of customers.

Thus, making the onboarding experience a lot less satisfying.

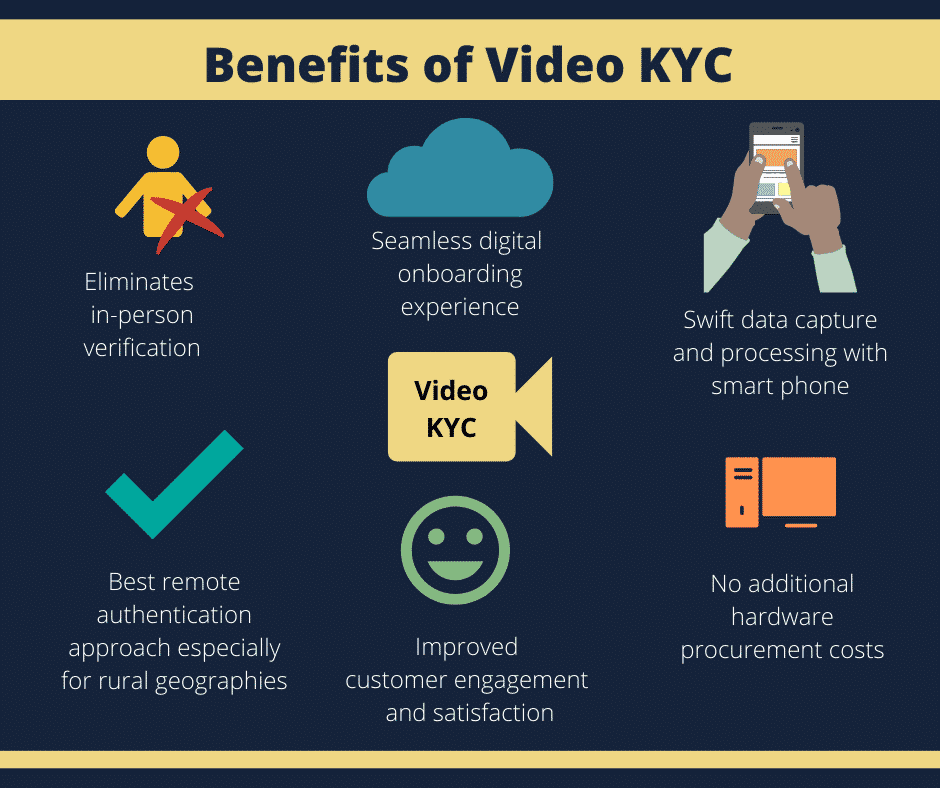

In way of doing away with physical documentation and in-person verification, RBI permits the use of video-based KYC proceedings. This remote customer authentication approach enables customer onboarding on-the-go and offers a seamless digital banking experience.

A video is all it takes to get it (KYC) done!

What is video KYC?

As the name suggests, video KYC is the process of capturing remote customer data via live video sessions. The remote process validates the customer identity (with the photo and proof of identity documents) and records the KYC transaction for audit purposes.

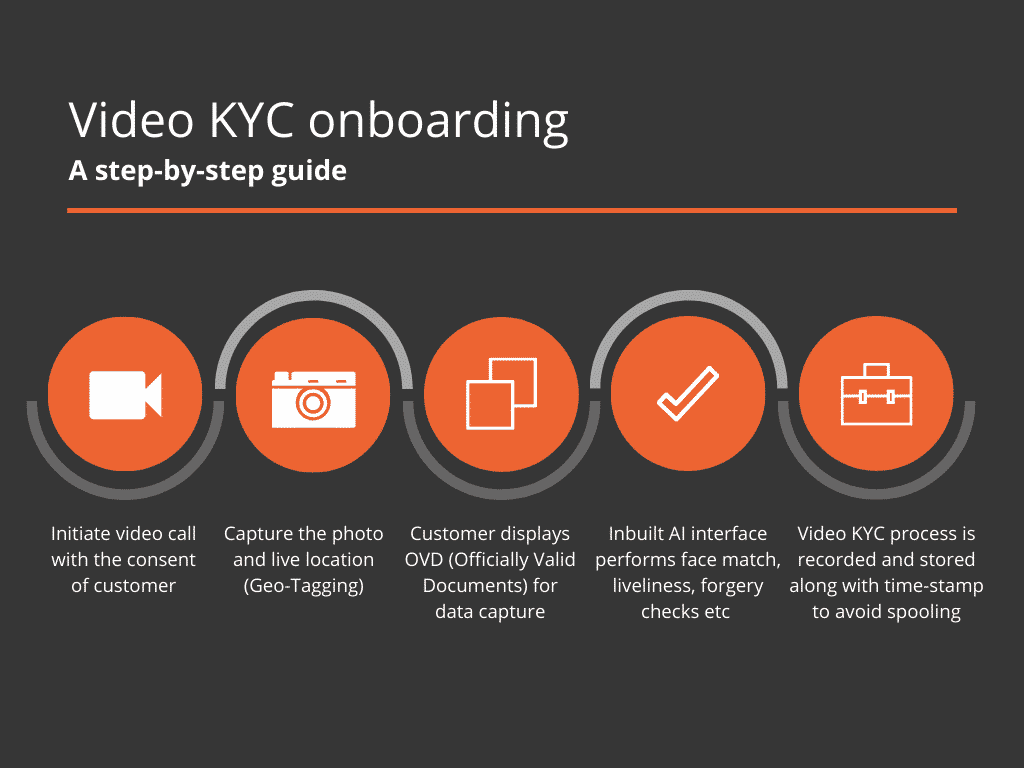

Onboarding with video KYC: How does it work?

Customer onboarding with video KYC is a simple and streamlined approach wherein stipulated officers capture the live photo, location of the customer along with officially valid documents over a mobile video call.

The recent amendment by Central bank allows financial entities to accept e-documents including ones digitally signed from their digital locker (Digi Locker) accounts.

Captured KYC data is then verified and matched with the details available in their official database as well as from the identity proofs provided (largely AADHAR/PAN).

KYC in the click of a button!

Norms to be followed while opting for video KYC:

In order to ensure effective implementation of video KYC, RBI has laid some ground rules to keep things in check:

- The remote onboarding facility can be carried out only by officials from Regulated Entities (RE) and cannot be outsourced by any means.

- It is mandatory to obtain the consent of the customer prior to getting started with video KYC proceedings.

- Live location of customer should be captured through Geotagging to ensure presence within India

- Authentication is done via AADHAR (online/offline)

- Complete video KYC transaction will be recorded with date and time stamp

- AI (artificial intelligence) and face-matching technologies will be employed to aid data processing

Benefits of video KYC:

Way forward:

Video KYC will be a great relief for banks, NBFCs, neo-banks and FinTechs eyeing to cut down their cost and ramp up their onboarding procedures.

Get ready for a future where opening a savings account, loan account, credit/debit cards, net banking user profile and more require nothing but a smart phone.

Grab video KYC facility and give your systems the superpower of quicker sign-ups!