Platformable, a consulting firm that helps companies and public bodies generate value through the use of APIs, recently published stats on the status of Open Banking which gives interesting insights especially on regional variations as also the products in favour.

Two facts stand out- growth in the European region (29%) was driven by the mandate to introduce APIs as part of the Second Payments Services Directive (PSD2) of September 2019; this also led to 274 fintech operators accredited as Account Information Service Providers (AISPs) and/or Payment Initiation Services Providers (PISPs) by Q1 2020. An interesting development is that most fintech providers had specific content in their API enabled products for use in the COVID-19 situation. For example, Ordo Pay, UK, focuses on small businesses but have fast-tracked a P2P app that allows transfer of instant payments to help someone shop for a home-isolated neighbour.Asia Pacific region has the second largest number of banks with API platforms and the largest number of API products. However, Account and Payment related APIs dominate the offerings, expectedly.

In India, where fintechs dominate the landscape, open banking got a major boost when the RBI became the first central bank globally to publish a common technology framework – including detailed APIs – for consent driven data sharing across the entire financial sector (banking, insurance, securities, and investment). Already, 3 AAs have received an operating licence while 4 others have an in-principle approval. At least 9 leading banks and NBFCs are in various stages of their FIP/FIU implementations. While personal finance management, wealth advisory would be among the top expected areas, it is digital lending that offers huge opportunities.

The value of India’s digital lending market is put at more than USD 1 trillion over the next five years. Although currently lending may be down due to the pandemic related lockdown, the vast credit demand and lacunae in reaching out to the underserved offer the right setting for a platform approach. But to ensure this, the players need to re-vision their digitalpriorities and move the industry from a vertically integrated architecture to a stack-based architecture.This would allow many entities to participate in different stack layers instead of the traditional role based approach, interacting across the stacks, working like a platform with APIs exposed to stacks above and below.

There are challenges- standardization of API protocols, designing touch points and data veracity and privacy. But the upside is the possibility to tailor specific lending products, such as cash flow-based lending -based on GST invoices, for example- to target groups such as MSMEs. AAs thus can allow lenders to access underserved segments- only 8% of MSMEs in India currently have access to formal credit! The AA framework in conjunction with the upcoming Public Credit Registry (PCR) will enable lenders to think out viable use cases.

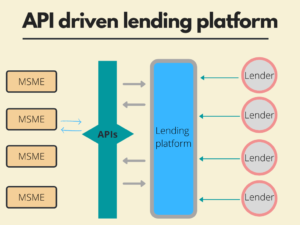

AnAPI driven platform based lending system using Account Aggregators (AAs) FIPs (Financial Information Providers) and FIUs (Financial Information Users) could look something like this

| Loan Request API | Loan requests would include details of the loan-amount, tenor, purpose, repayment method. AAs can speed up data access, receiving data of the borrower in real-time, digitally signed by the FIP, e.g. the borrower’s bank and quicken the loan sanction process by eliminating manual data. |

| Data enrichment API | A third party could aggregate critical customer credit data from CIBIL and alternate sources for sharing with lenders. |

| Loan Inquiry API | Lenders would be able to query a loan based on key inputs like expected Credit Score, Amount, Type of Customer etc. |

| Loan Confirmation API | Lender approves/rejects the loan |

| Loan disbursement repayment API | Loan instalments would be deducted and credited to lender, using payment APIs. |

The advantages of using APIs for customers are clear-they can initiate payments and report them from their own environments, without creating files or without having to enter data into a bank’s portal or wait for the bank to finish processing a request. APIs can thus help the bank’s customers to bypass the need to directly interact the bank at all. But the legacy systems at many banks still require payments to be batched and files to be created and then uploaded to a bank’s portal. Which is perhaps why most traditional banks have been slow to offer APIs. There is also the fear that banks would stand to lose to fintechs in the bargain. Also, in many countries, market players have either not been able to come together to agree on a common technical standard for APIs. In India, we seemed to have crossed that hurdle and are also now closer to addressing data privacy concerns. We have already seen how UPI, the classical API use case, disrupted payments. We cannot rule out something similar happening in lending.