Will OCEN be the UPI of lending?

The problem of universal access to credit seems elusive. The issues are all too familiar. Traditional players like banks and NBFCs still rely on old world methodologies (balance-sheets, collateral) with largely ‘one-size-fits-all’ credit products. These products follow a bank-centric design, and not a borrower-centric design.

The fallouts are huge, as this traditional approach results in a large chunk of lower income and MSME customers being left out of the game. This is evident in the much quoted INR 25 trillion credit gap in the MSME sector.

There has been significant progress in financial inclusion ushered in by the JAM trinity (Jan Dhan – Aadhaar – Mobile), that has enabled millions of rural bank accounts, mobile connectivity, sophisticated payment systems, FinTechs in digital lending and so on. Despite this progress, financial reach remains elusive to borrowers at the lowest rung of the economic pyramid.

To solve this gap, a new credit protocol infrastructure was announced by Nandan Nilekani (Aadhaar architect, and Infosys chairman) at the global fintech festival in July 2020, that has been making waves in FinTech circles ever since.

Named the Open Credit Enablement Network (OCEN) and pronounced as ‘O-ken’, it is an ambitious venture with a completely re-imagined lending landscape and empowered entities designed to play important roles in the credit value chain.

Re-imagining the lending landscape

Many remarkable changes took hold of the Indian FinTech scene in the last decade: the emergence of marketplaces, platforms and account aggregators, a robust and unique public API infrastructure (the India Stack), and a data driven digital lending ecosystem.

Yet, the lending landscape continues to be fragmented.

The gap in the works is perhaps owing to a lack of thought that integrates all these fragments, and enables money to flow without restrictions or privilege blocks.

This gap is precisely what iSPIRT, the think tank behind India Stack and innovations such as Aadhar/UID, DigiLocker, and UPI, has tried to close.

OCEN, the latest offering from iSPIRT seeks to stitch together a network of lenders, borrowers, credit bureaus, underwriters, tech companies, Account Aggregators (AAs) and a new set of players called Loan Service Providers (LSPs).

This connected ecosystem is built to operate under a common standard in the credit value chain.

A standardized tool kit (the equivalent of the various components of a typical lending value chain) is the centerpiece of this vision, which would allow any app, marketplace, and aggregator to ‘plug in’ lending into their current operations.

Effectively, it combines Open banking, Account Aggregation and Platformification all rolled in one. It is open because OCEN specifies a set of public APIs which must be used, while common standards enable participants to communicate without the need for customized tech integrations.

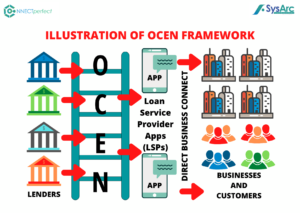

How does OCEN work? A visualization of the OCEN system (Courtesy: Sahamati)

Illustration of OCEN Framework

The entire credit value chain is expected to reap the benefits of using low cost public infrastructure, thus not only reducing costs but also removing any friction in existing processes.

The workflows in the re-imagined credit value chain are illustrated below.

__

| Workflow | Participant/Tool | How it will work |

| Loan Origination | LSPs | The LSP’s interface allows borrowers to engage with lenders. |

| KYC | eKYC, PAN, AAs | Data flows from various sources- some through OCEN APIs, some from credit bureaus and utilities such as eKYC and NSDL (for PAN verification) while data such as bank statements and GST invoices, will be got through AAs. |

| Credit Underwriting | LSPs, AAs | Data from LSPs through OCEN APIs |

| Loan documentation | eSIGN | Done electronically on the LSP’s interface through OCEN APIs. |

| Loan Disbursals | NEFT, IMPS, RTGS, UPI | Using the existing payments infrastructure |

| Loan collections | LSP, eNACH, credit card, UPI e mandate | Auto-repayments using credit card, electronic NACH mandate, or UPI e-mandate.

The OCEN APIs also allow the LSPs to forward a lender’s repayment link to the borrower for direct payment execution. |

| Loan Monitoring | AAs | Lender after taking borrowers’ consent, gets the required data from AAs to monitor the loan accounts. |

__

LSPs (loan service providers) will be the key players: typically, these could be marketplaces or platforms that have their own captive pool of users, who could now be connected to lenders.

For instance, a food delivery app such as Swiggy could be the LSP that helps restaurants (or customers) get access to credit through the OCEN rails.

Currently, this happens through embedded finance, where non-financial service providers such as, say, LazyPay try to build credit modules into their platforms.

With OCEN, they do not have to build bilateral rails with lenders, and instead can use the standard tools to enable micro credit. With OCEN, virtually any aggregator with a decent customer base and reliable data can sign up as LSPs.

OCEN eventually visualizes a landscape dotted with kirana store tech players, food delivery apps, taxi hailing apps, logistics companies, education tech platforms, SaaS providers, and others who are in the business of aggregating users (whether businesses or individuals) – together acting as credit enabled platforms.

Account Aggregators (AAs) are the other vital cog in this machine. AAs move the data around from borrowers into lenders onboarding and underwriting processes.

Importantly, OCEN requires LSPs to embed APIs of AAs into their flow, and lenders also need to have AAs FIP and FIU (financial information providers, and users) modules implemented.

How will this help banks and traditional lenders? In many ways. Firstly, the cost of customer acquisition becomes virtually zero, because platforms already own them.

Secondly, the data that exists with LSPs (ordering history, payment history, etc.) offers improved ways of assessing credit worthiness.

This significantly changes the lending paradigm from balance sheets and collateral-based to cash flow-based lending. Finally, the fact that entire lending processes can now be digitized right from customer acquisition, to data collection, to monitoring, to repayment, making it easier for banks to innovate better credit products tailored to specific needs.

Though only running a few pilot projects now, OCEN seems to offer the best hope yet for the financial inclusion problem.

To read our blog about OCEN and digital lending, read our blog here.

To read our blog on how APIs are used across industries, click here.

To read our blog on millennials and finance, click here.

Click to see how CONNECTperfect enables seamless API orchestration to automate and expedite any financial process, including lending.